1031 Exchange Fund Can Be Fun For Everyone

Table of ContentsHow What Is 1031 Exchange California can Save You Time, Stress, and Money.The Basic Principles Of What Is A 1031 Exchange California See This Report on 1031 Exchange California7 Easy Facts About 1031 Exchange Rules DescribedOur 1031 Exchange Real Estate StatementsSee This Report about 1031 Exchange California

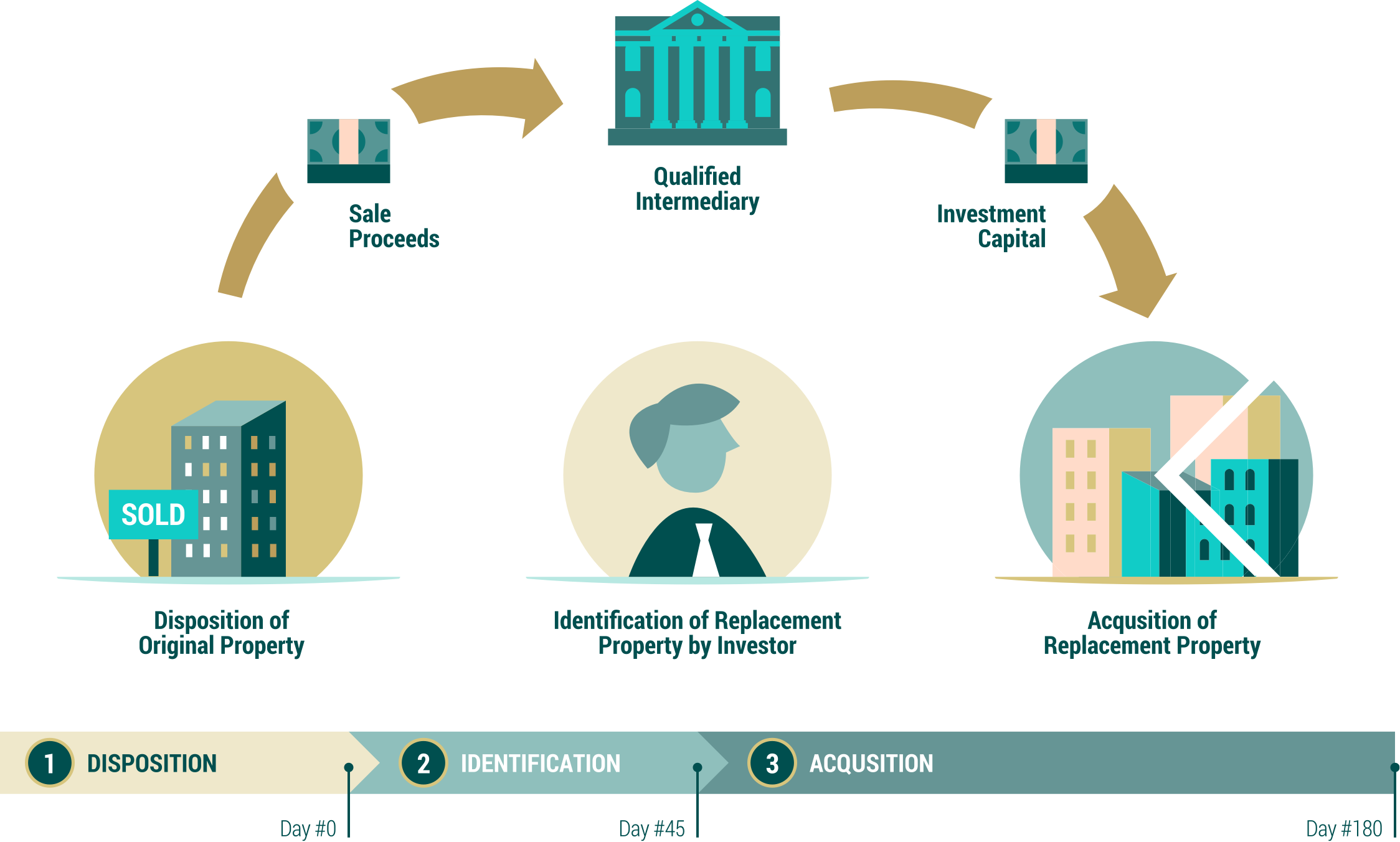

Within 45 days of the transfer of the residential property, a building for exchange must be recognized, as well as the deal should be carried out within 180 days. Like-kind properties in an exchange must be of comparable value as well. The distinction in worth between a home and the one being exchanged is called boot.If personal effects or non-like-kind property is made use of to finish the deal, it is additionally boot, however it does not invalidate for a 1031 exchange. The existence of a mortgage is permitted on either side of the exchange. If the mortgage on the substitute is less than the home loan on the residential or commercial property being sold, the difference is dealt with like cash money boot.

Costs and also fees influence the worth of the purchase and also as a result the possible boot too. Some costs can be paid with exchange funds. These include: Broker's payment Qualified intermediary charges Declaring fees Related lawyer's fees Title insurance coverage costs Relevant tax advisor charges Finder fees Escrow charges Costs that can not be paid with exchange funds consist of: Financing fees Building taxes Repair work or upkeep expenses Insurance premiums LLCs can just trade residential or commercial property as an entity, unless they do a in situation some companions desire to make an exchange and also others do not.

Facts About 1031 Exchange California Revealed

1031 exchanges are performed by a solitary taxpayer as one side of the transaction. Consequently, special steps are required when participants of an LLC or collaboration are not in accord on the disposition of a property. This can be rather complicated due to the fact that every homeowner's circumstance is special, but the fundamentals are universal.

A 1031 exchange is executed on residential properties held for financial investment. A significant analysis of "holding for financial investment" is the size of time a property is held. visit site. It is desirable to launch the decline (of the companion) a minimum of a year prior to the swap of the asset. Or else, the partner(s) joining the exchange may be seen by the IRS as not fulfilling that requirement.

This is referred to as a "swap and decline." Like the drop and also swap, tenancy-in-common exchanges are another variation of 1031 transactions. Tenancy in common isn't a joint venture or a collaboration (which would certainly not be enabled to participate in a 1031 exchange), yet it is a connection that enables you to have a fractional possession interest directly in a large property, together with one to 34 more people/entities.

The Greatest Guide To 1031 Exchange

Purely speaking, occupancy alike grants investors the capability to have a piece of property with other proprietors yet to hold the exact same rights as a solitary owner. Lessees alike do not require approval from various other lessees to get or market their share of the residential property, however they frequently should meet specific economic requirements to be "approved." Tenancy alike can be used to divide or combine financial holdings, to branch out holdings, or acquire a share in a much bigger asset.

The Facts About 1031 Exchange California Uncovered

The tax obligation deferment provided by a 1031 exchange is a remarkable opportunity for investors. Although it is intricate at points, those intricacies enable a good deal of flexibility. This is not a procedure for an investor acting alone. Competent expert help is required at practically every action. CWS Funding Allies has experience managing the entire 1031 exchange process for you as well as can collaborate with you to give replacement assets when you need them.

The info offered here is for your basic informative functions just. CWS has made this 3rd celebration information readily available from authors it thinks are experienced as well as dependable sources.

Little Known Facts About What Is A 1031 Exchange California.

You need to acquaint yourself with all threats linked with any type of investment item before investing. Advisory solutions are offered by CWS he said Capital Allies LLC, an authorized investment advisor.

A 1031 exchange is a type of actual estate acquisition enabled under Section 1031 of the US Internal Earnings Code."How a 1031 exchange works, The precise 1031 exchange procedure depends on the kind you're using (much more on this later).

Then, like lots of capitalists, you'll possibly wish to have a qualified intermediary hold the earnings of your sale up until you've determined the residential property or properties you wish to acquire. Afterwards, you have 45 days to discover your substitute financial investment as well as 180 days to purchase it. You can expect a certified intermediary to set you back around $600 to $1,200, relying on the purchase.

Rumored Buzz on 1031 Exchange Real Estate

For property rental homes, the advantage is slowly expanded over 27 years. Usually, if you used devaluation to your advantage, after that you 'd owe what's called devaluation recapture - or income taxes on the economic gains you realized from doing so - when you market the residence. Utilizing a 1031 exchange can permit you to push these repayments bent on a later day. tax shelter real estate.

You'll still owe a variety of closing expenses as well as various other charges for buying and offering a building (why not try here). Numerous of these might be covered by exchange funds, however there's dispute around exactly which ones. To discover out which expenses as well as charges you may owe for a 1031 exchange transaction, it's best to speak with a tax expert.